InfraRed Capital Partners Acquires Majority Stake in Voltan Energy and Allocates €75 Million to its Growth

The international infrastructure asset manager, InfraRed Capital Partners, has acquired a majority position in Voltan Energy for an undisclosed amount, with a growth equity allocation of up to €75m made available to Voltan Energy. InfraRed believes in the strong growth of environmentally friendly heating and cooling services.

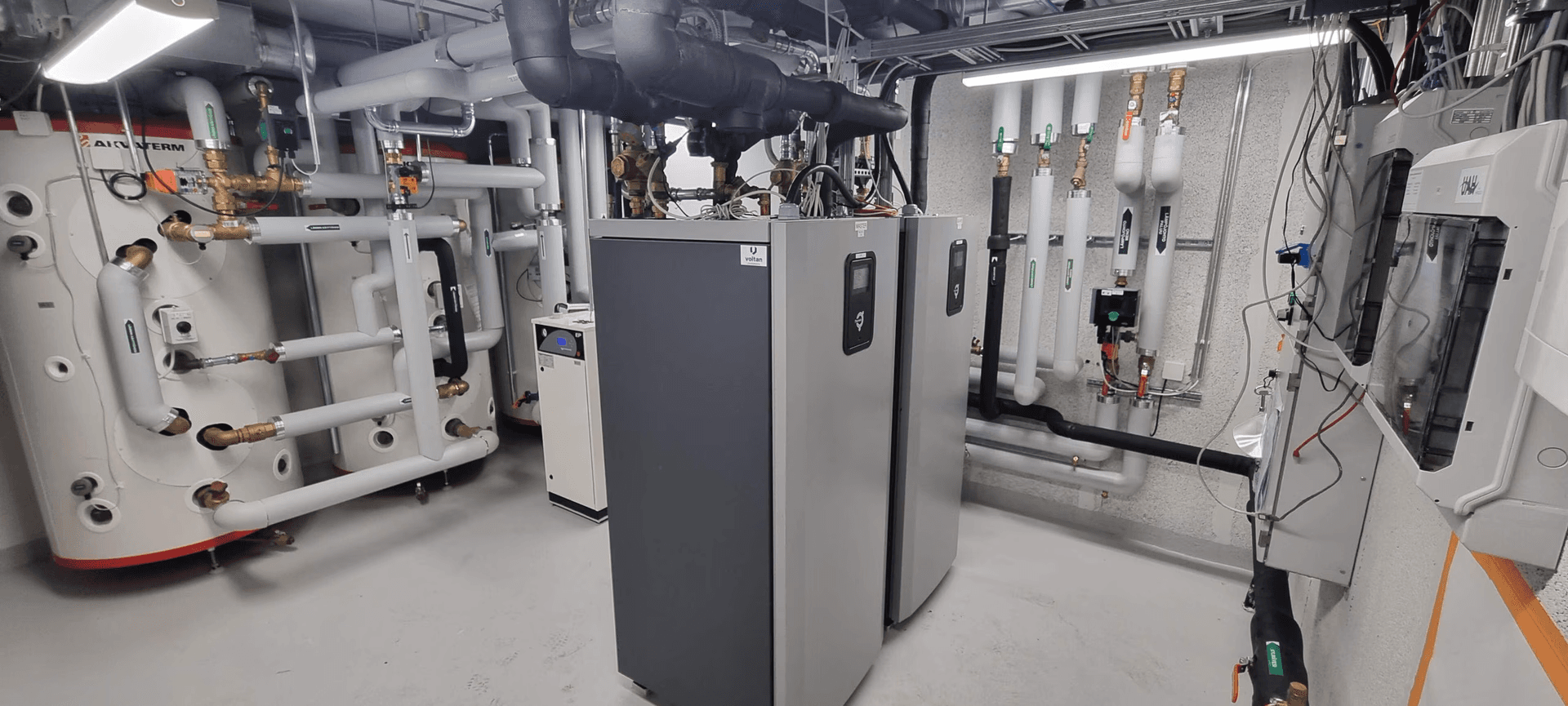

InfraRed Capital Partners (“InfraRed”), the international infrastructure asset manager, on behalf of one of its Value-add strategies, has acquired a majority stake in Voltan Lähienergia Oy (Voltan), a company specializing in the installation and operation of ground source heat pumps in apartment buildings and other large structures. The founding owners of Voltan will remain as shareholders in the company.

Stephane Kofman, Head of Value-Add Funds, InfraRed Capital Partners, commented:

"Voltan has successfully established a strong initial footprint and reached a critical step from which our growth capital and expertise can help accelerate its development and ambition. There is a clear need for Voltan’s compelling and differentiated business proposition in Finland and beyond, delivering sustainable heating and cooling to those living and working in urban environments. The management team is highly motivated, with deep expertise in the sector and a clear understanding of the market opportunity. As an active asset manager, we look forward to working closely with them to add value and deliver on Voltan’s potential.”

Heating And Cooling as a Service

Founded in 2020, Voltan works with local housing companies and developers to install and operate its Heat-as-a-Service (HaaS, heat as a service) service model, which uses ground source heat pumps to provide customers with reliable, clean and cost-effective heating and cooling all year round, without installation costs.

Voltan currently has ten ongoing projects in Finland. Also, it has signed contracts for 35 additional sites. "Our order backlog reflects market expansion," Voltan's CEO Miikka Lemmetty analyzed. "There is strong demand for stable and competitive energy pricing and sustainable energy," Lemmetty explained. "Voltan, previously focused on domestic expansion, now plans to scale its operations internationally to meet similar needs in other European countries," Lemmetty said. According to Lemmety, InfraRed's growth funding will help Voltan better serve current and future customers in existing and new segments. "The funding also makes it possible to grow the organization, now with broad shoulders in the background."

Long-term Growth Potential

InfraRed's Value-add strategies invest in early-stage companies with long-term growth potential, such as Voltan, and drive value through developing, constructing, commissioning, and operating the underlying asset base while growing platform pipeline and capabilities.

Voltan's growth expectations are reinforced by the global drive to adopt new technologies to achieve net-zero greenhouse gas emissions – technologies, such as decentralized, environmentally friendly heating and cooling systems. In Finland, the national goal is to achieve net zero emissions by 2035. The government is working to reduce various non-combustion-based heating and cooling systems and replace them, for example, with heat pumps. Ground source heat pumps offer a sustainable and competitive alternative to other heat sources, such as district heating, which are typically based on combustion technology.

More information:

About InfraRed Capital Partners

InfraRed Capital Partners is an international infrastructure asset manager, with more than 160 professionals operating worldwide from offices in London, Madrid, New York, Sydney, and Seoul. Over the past 25 years, InfraRed has established itself as a highly successful developer and steward of infrastructure assets that play a vital role in supporting communities. InfraRed manages US$13bn+ of equity capital for investors around the globe, in listed and private funds across both core and value-add strategies.

A long-term sustainability-led mindset is integral to how InfraRed operates as it aims to achieve lasting, positive impacts and deliver on its vision of Creating Better Futures. InfraRed has been a signatory of the Principles of Responsible Investment since 2011 and has achieved the highest possible PRI rating for its infrastructure business for eight consecutive assessments, having secured a 5-star rating for the 2023 period. It is also a member of the Net Zero Asset Manager’s Initiative and is a TCFD supporter.

InfraRed is part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life. InfraRed represents the infrastructure equity arm of SLC Management, which also incorporates BGO, a global real estate investment management adviser, and Crescent Capital, a global alternative credit investment asset manager.